It all started with a simple request: people wanted to pay in dollars without conversion fees, make international purchases, and avoid opening foreign bank accounts. Traditional banks reacted slowly, but fintech companies acted quickly.

This led to the creation of virtual cards that could be issued online in just a few minutes—no physical card, no branch visit required.

Initially, they were mainly used for paying for advertising, subscriptions, or services like Google Ads or Upwork. Over time, it became clear that if the tool was this convenient, why limit it to just work purposes?

With a virtual card, you can book flights, pay for hotels, shop on international websites, access streaming services, and manage subscriptions. All this without complicated currency conversions or the fees that often appear with regular cards.

In fact, virtual cards brought banking products to the form people had long been waiting for—fast, secure, and hassle-free.

Fintech vs. traditional banks

For decades, banks built infrastructures where every step required time and documentation. Fintech went a different way, focusing not on the product itself but on the user experience.

Most international stores and online services accept dollars. Even if payment is made in euros or pounds, many systems still convert it through the dollar.

Paying with a regular card in a local currency often results in double conversion—first to dollars, then to the store’s currency. But nobody wants to overpay. Many services now offer digital dollar solutions that anyone can create without limitations. For example, separate cards for subscriptions, travel, and personal expenses, all fully under control and without extra fees.

1. Spend.net

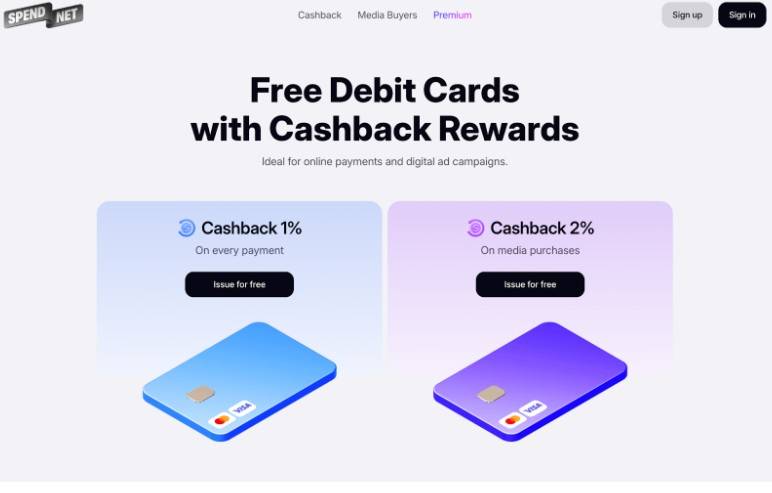

Spend.net ranks first among virtual cards due to its speed and simplicity. Cards are issued within minutes after registration via email or a social login. There’s no waiting for bank confirmations or long verification — basic functionality is available immediately, and full verification takes no more than an hour.

The main advantage is instant readiness for payments. Users fund the account via cryptocurrency, and the card is immediately usable. No hidden fees for transactions, withdrawals, or declined payments. All operations are free except a small top-up percentage, which the user sets themselves.

Another benefit is automatic cashback — every purchase via virtual dollar cards returns a 1% to the balance without conditions, turning everyday spending into savings.

Security is strong: the cards support 3D Secure, so each online payment is verified via a code sent to your phone, protecting against fraud without slowing down the process.

Unlimited cards can be issued, which is useful for separating expenses: subscriptions, shopping, travel—each purpose has its own card. Management is easy, and 24/7 support via online chat helps solve any issues quickly.

Instant issuance, immediate access to funds, no extra fees, and continuous cashback make this platform a leader in virtual dollar cards, allowing fast, secure, and beneficial payments.

2. PSTNET

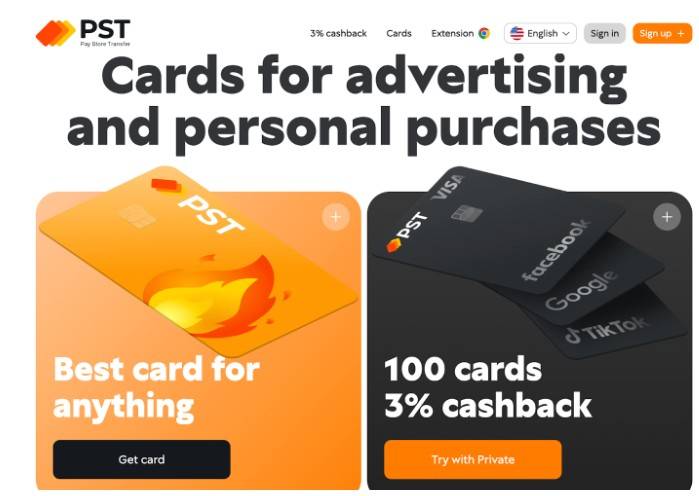

PSTNET provides Ultima virtual cards accepted worldwide. They work with Visa and Mastercard networks, making them suitable for all international purchases from digital subscriptions to luxury cruises.

The main feature is flexibility: if a user maintains a certain monthly volume, Ultima cards become free, with no issuance or maintenance fees. Different plans are available: weekly payments or a discounted annual fee. Operational costs are minimal, with no transaction, decline, or withdrawal fees.

PST.NET registration is easy through Google, Telegram, WhatsApp, Apple ID, or email. Cards are issued immediately after logging in. Security meets banking standards with 3D Secure and two-factor authentication.

Financial management is convenient. Users can issue unlimited cards to separate spending: one for subscriptions, one for travel, another for shopping. A browser extension allows quick access to balance, transaction history, and one-click freezing.

Top-ups are available in 18 cryptocurrencies, including BTC, USDT (TRC20, ERC20), TON, and DOGE, as well as SEPA/SWIFT bank transfers or Visa/Mastercard top-ups.

User support is available 24/7 via Telegram chat or bot notifications. PSTNET provides a convenient way to manage spending and make dollar payments internationally.

3. Volet

Volet offers universal cards for all international payments. Top-ups in dollars are processed by converting crypto to fiat and loading the account. Fees start from a small fixed amount plus a percentage per top-up, with minor additional charges for cross-currency payments.

Security includes 3D Secure and two-factor authentication. Users can fund accounts via cryptocurrency, bank transfers, or other cards. Registration involves account creation, KYC verification, and wallet setup. Customer support is accessible via chat and email.

This service is suitable for frequent crypto users who need flexible, multi-currency cards, though funding procedures and extra fees make it less convenient for instant use.

4. Payoneer

Payoneer issues virtual and physical cards supporting major currencies: USD, EUR, and GBP. They are accepted internationally and automatically convert currencies when needed, ensuring seamless transactions.

Designed for freelancers and businesses working with foreign clients, payments in dollars and euros are processed without additional fees. Withdrawals and ATM cash-outs have transparent charges. Daily and withdrawal limits are clearly defined, and two-factor authentication protects every transaction. Users can track balances in real time via web or mobile app.

Funds can be added via bank transfer or cryptocurrency, supporting multiple payment sources. Registration is simple, and cards are activated after identity verification. Premium users receive priority support.

5. Pyypl

The Pyypl platform provides prepaid digital accounts recognized worldwide. They are intended for extended use with no overall spending restrictions, although individual purchases have a limit. Charges per transaction are clear, with no extra service fees.

Funds can be added using various cryptocurrencies or alternative cards. Account setup requires identity confirmation to guarantee safety. Each account features 3D Secure to safeguard online transactions, and support is available around the clock.

These accounts are perfect for individuals managing internet and cross-border expenses securely, reliably, and without long delays for activation.

A plastic-free world: why digital cards became a global trend

Digital cards have become what smartphones were to phones. A phone once only made calls; now it’s a bank, wallet, ticket, navigator, and ID all in one. Money is changing the same way. It’s no longer a physical object — it’s data, and managing it digitally is more convenient.

The world is shifting to digital payments. By 2023, 50% of all online transactions globally were made via digital wallets, including virtual cards and mobile money — half of all online payments.

Credit cards accounted for 22% and are expected to drop to 15% by 2027.

Digital payments are growing rapidly and steadily, with an annual growth rate projected at 14.9%.

This means that within a few years, virtual cards will no longer be considered “special”, they will be a routine part of financial life.

Now it’s just a matter of choosing which service to try first.